This side business article is for educational purposes and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

You love your job but want to branch out and earn a little extra income. Or you may still need to work full time while you carve your own path. Whatever the case, learning how to start a side business could be the smartest thing you ever do.

The extra income you earn can allow you to:

- Pay off that credit card

- Put a down payment on a car

- Finally go on that holiday

- Buy your own home and more

Additionally, you never know where a side gig might take you. It could grow and earn you an extra couple of hundred dollars a month — it could even become a small business that nurtures your soul.

If you're ready to dive in, follow the steps below as a general guide to help get you started.

How to start your side business

There are many ways to earn extra income. But this ‘extra’ income should not include any funds derived from things like a day job or studies.

The amount of effort you need to put into your side job can vary, depending on your profession. Some side jobs can:

- Allow you to earn more money than others

- Require more time

- Suit your personality, skills and talents better

- Require start-up costs (think licensing, permits, training, inventory or capital purchases)

It’s best to work out what you would like to earn and how much time you can put towards your idea before getting started. Here are three steps you should take before getting started:

Make a list of ideas: Do your research and take your time before you make your decision. Your side business will have a better chance of success if you love what you do and are good at it.

Make a list of ideas: Do your research and take your time before you make your decision. Your side business will have a better chance of success if you love what you do and are good at it.- Do a trial run: See if your idea fits in with your lifestyle. If you like doing it as a business (and not just for fun), then you may be ready to fully commit to the venture.

- Put your side job together: Once you have your idea and you’ve decided which direction you’d like to go, then it’s time to consider the finer details.

If you follow these steps in order beforehand, you’ll have an easier time fine-tuning the rest of the work later.

Related: 25 side hustle jobs to make money

1. Choose your business structure

Choosing the right business structure is important since it will dictate how you’ll trade, determine your rights and lay out your responsibilities.

You’ll need to choose a business structure that protects you against litigation and determines how you'll be taxed.

There are a number of business structures you can select from, including:

- Sole trader – This is the simplest structure available and gives you full control of your business.

- Company – This is a more complex business structure. But it protects your personal liability because it’s a separate legal entity.

- Partnership – This is made up of two or more people who distribute income or losses. Both parties operate under a sole trader business structure within the partnership.

- Trust – A trustee is responsible for business operations and a trust operates under a different legal structure. The trust is dependent on the type and how it's set up. It’s often the hardest to modify and typically doesn't change once started.

Below we’ll discuss each one in more detail to help you get a better understanding.

Sole trader

A sole trader business structure gives you full control of your business assets and allows you to have autonomy with your business decisions. You decide on things like:

- The product or service you’ll sell

- The contractors and supplies you’ll use

- How much work you want to take on

You also won’t need a separate bank account. However, it’s a good idea to open one and keep your business and personal money separate.

Sole traders are personally responsible for the legalities of their business.

The owner’s personal assets are at risk because the unlimited liability of your side business is your personal responsibility.

This business structure requires fewer reporting requirements and is the simplest to set up.

However, it’s worth it to use good accounting software to help you stay current with your finances.

You’ll need to work out if your side business is profitable by looking at:

- Invoices

- Remitting receipts

- Keeping track of your expenses and profits

Related: How to prepare a trial balance

What you need to know about sole trader taxes and accounting

When it comes to lodging a tax return, a sole trader can use their personal Tax File Number (TFN).

The owner is personally responsible for paying taxes on all money earnings that are deemed the personal income of the owner. Income that can be claimed on tax deductions include:

- Personal

- Business concessions

- Grants (should they be applicable)

Additionally, a sole trader does not need an Australian Company Number (ACN) to start a side business. However, you’ll need an Australian Business Number (ABN) and need to keep your accounting records for five years in case of auditing.

Note: If your sole trader business earns over $75,000 gross annual turnover, you’ll be required to register and collect the Goods and Services Tax (GST).

Related: What are the tax differences between a sole trader and a company?

Company

A company is set up as a separate legal identity that can:

- Incur debt and profits

- Earn an income

- Be held responsible for all legalities (the company, not the owners)

Companies can be expensive and complicated to set up, so this business structure best suits owners who:

- Expect a high return

- Want the option to use losses to offset future profits

- Need a higher level of legal protection

A company’s business operations are controlled by directors and owned by shareholders. It also must:

- Lodge its own tax returns each year

- Complete an annual review

- Pay an annual renewal fee

- Register to pay and collect the GST if turnover is $75,000 or more.

Partnerships

A partnership is made of two or more people who distribute income or losses between themselves. This business structure is easy and inexpensive to set up, plus has minimal reporting requirements.

Each partner is required to use their personal Tax File Number (TFN) to lodge their own tax return. A partnership return should also be lodged each year with its own unique tax file number.

All partners share control, decisions and management of the business.

Each partner pays income tax on their share of the income and must lodge an annual tax return. The entire partnership must also register to pay and collect the GST if turnover is $75,000 or more.

Trust

A trust is a business structure that carries out tasks and management on behalf of the trust's members (or beneficiaries). This is completed by a trustee who decides how profits are distributed.

A trustee can be a person or a company and is responsible for income and losses within the trust.

Trust structures are generally set up to protect business assets of beneficiaries. Trusts typically are:

- Expensive

- Complex

- Hard to set up

Trusts can also be hard to dissolve once established. It’s best to seek professional advice when determining the type of trust that’s most beneficial for your business.

2. Decide if you’ll need employees or contractors

If you're working or studying full-time, you may not have the necessary time to dedicate on all levels of your side business. In this case, you may decide to outsource some of your tasks when the need or time arises.

When hiring people, it’s best to understand the differences between contractors and employees. Each has different obligations that can affect:

- Reporting

- Legal

- Tax

- Superannuation

Do your research beforehand and go with whatever fits your business needs best.

Employees

An employee works in someone’s business. Their employer controls:

- How they work

- When they work

- Any constraints they will need to work under

Employees are paid a salary or wage and are required to perform tasks in a certain manner.

A business will need to report an employee’s tax and super obligations directly to the Australian Taxation Office (ATO). This is completed using Single Touch Payroll (STP) for each pay roll period, which means a business will need STP-enabled software to do this.

If you hire an employee, you’ll need to collect and pay their tax obligations on their behalf. This is known as Pay-As-You-Go (PAYG) and you’ll need to tax your employee at the correct marginal tax rate.

It’s important you ensure you’re withholding the correct amount for them.

The minimal pay rates for awards and the national minimum wages are reviewed every year — changes usually take place around 1 July. Pay rates will change when:

- A junior employee has their birthday

- An apprentice or trainee reaches an employment period milestone

- Your employee’s role changes

If you offer certain perks to your employees, you might incur Fringe Benefits Tax (FBT). You’ll need to register for FBT and make payments between 1 April and 31 March each year. Examples of fringe benefits include providing an employee with a car, accommodating car parking spaces and more.

You can find out which benefits are subject to fringe benefits tax (FBT) and how to work out the taxable value of the benefits here.

You’ll need to keep employee records for seven years, including records about their:

- Employment

- Pay

- Hours of work

- Leave

- Super amounts

Records should be kept for five years relating to tax and superannuation amounts. You’ll also need to keep records on how you met your choice of super fund obligations.

Related: What you should know about employee rights before you hire

Contractors

A contractor is set up differently than an employee. Contractors operate under their own business terms and have their own invoicing and reporting obligations. A contractor can include:

- Subcontractors

- Consultants

- Independent contractors

Many of these contractors can also operate as any of the four business structures mentioned earlier.

Their tax and super obligations will be different from those of an employee. Depending on the contract you offer, you may need to pay PAYG and superannuation on behalf of your contractors. But this is often the contractor’s responsibility.

Note: You may be required to lodge a Taxable Payments Annual Report (TPAR) by 28 August each year for each contractor you employ. Work out if you need to lodge a Taxable payments annual report here.

3. Choosing your business name

Your business name is the name you’ll trade under.

Choosing the right name is important because it’s how you’ll be known in the marketplace.

Here are a few tips to consider:

Choose a name that’s easy to remember, spell and pronounce.

Choose a name that’s easy to remember, spell and pronounce.- Make your business name short and simple.

- Keep your name descriptive, fresh and different than your competitors.

- Select an image that portrays your business best.

- Keep tabs on the competition.

- Ensure your idea isn’t the same as another business.

- Check for trademarks, registrations and copyright on any business name you’re considering.

- Determine if the matching domain is free for your business name.

Once you’ve chosen your business name, you’ll need to register it with the Australian Securities and Investments Commission (ASIC). This will allow your business to operate in any state or territory.

If you want exclusive right to your business name, consider registering a trademark. Registering a trademark is costly, so consider if you need to take this step at the side business stage.

Related: How to name a business

See if the name you want is available now

4. Finding a location

At first, you may find that working out of a small area in your home is best for your budget. But there might come a time where you’ll need more room to run your business and the kitchen table won’t be big enough.

Possible ways to upgrade your location include:

- Dedicating a larger home office space

- Investing in a warehouse for products or parts

- Designating an external space to meet clients or employees in

All of these decisions will incur tax obligations. If you’re aware of them, you can plan to use them to reduce your tax.

Knowing what you can and can’t deduct is a must when sourcing out a location for your business.

It’s important to ask for tax concessions you may be eligible to receive. Let’s review some important deductions and expenses you’ll need to consider below.

Home office deductions

A lot of side business owners use their home as their place of work. There are two types of tax deductions that can be claimed if you work from home: running and occupancy expenses. I’ll review both down below.

Running expenses

There are two ways in which you can claim these types of deductions:

1. Fixed rate method:

You can claim 70 cents per hour you worked from home in the financial year 2024 to 25. This rate incorporates things like:

- Electricity and gas for heating

- Cooling and lighting

- Phone and internet

- Cleaning and repairs of your home office

It also will include the decline in value of your office fittings and furnishings.

2. Actual cost method:

This calculates the actual costs for all of your expenses

Occupancy expenses Home occupancy expenses include:

Home occupancy expenses include:

- Rent

- Mortgage interest

- Council rates

- House insurances

- Land taxes

Keep in mind that if you are eligible to claim occupancy expenses, you may incur Capital Gains Tax if you sell your home. This is still the case whether you decide to actually claim the occupancy expenses or not.

If you’re looking for help when negotiating your leasing or renting options, try seeking out advice from:

- Accountants

- Solicitors

- Business advisors

Should you need help, these professionals will work in the best interests for your business.

Note: A tax accountant will advise you of tax strategies and put things into place so you don’t pay too much tax and recoup where you can.

5. Getting the proper registrations, licenses and permits

There are licenses and permits you might need to take out in order to do some business activities. These will help protect you and all of the following parties, should you need it:

- Your business

- Your employees

- Your customers

Whether you need any licenses or permits will depend on your side business activities and location. After understanding the requirements and to ensure compliance, learn how to register your small business. The Australian Business Licence and Information Service (ABLIS) can help you find the following items you need for your business.

- Licences

- Permits

- Council approvals

If your business doesn't have the right registrations, it can affect your tax rate or result in penalties or fines.

Use this ABLIS tool to find the licences and permits you need.

6. Understanding your finances

If you have a separate bank account for your side business, it’s easier to:

- Track expenses

- Make payments

- Understand your cash position

If you’re a sole trader, you can use your own bank account, but it's not recommended.

Your best bet is to keep your business and personal bank accounts separate, even when your side business is just starting up.

Partnerships, trusts and companies require a separate bank account for tax purposes.

Prepare your budget

A budget will help you forecast income and expenses, as well as manage your cash flow. Your cash flow is all of the money that comes into your business and can include:

- Sales

- Debtor receipts

- Grants

- Tax rebates

To properly calculate your cash flow, you’ll need to work out your total incomings and your cash outgoings. Outgoings include:

- Accountant fees

- Advertising and marketing

- Purchases

- Rent and sales

- Utility expenses

Calculate your monthly cash balance to work out the financial health of your side business.

It’s helpful to keep track of your income and expenses using accounting software such as:

- QuickBooks

- Xero

- MYOB

You can use these to keep track of your records for your tax.

7. Your tax obligations

Understanding the tax obligations for your side gig will save you time and money in the long run.

By claiming all of your deductions you’ll lower your overall tax bill.

Staying organised and paying on time will keep you from paying penalties or late fees.

There are different types of taxes that your side business might incur:

- The goods and services tax (GST)

- Income tax for your business

- Capital gains tax (CGT)

- Fringe benefits tax (FBT)

- Pay as you go withholding (PAYG)

How do tax deductions work?

Tax deductions are taken away from the income you earn. Reduced income means reduced tax payable on that income.

For example, say you earn $65,000 and pay $14,000 in tax. This means your tax refund would be $1,133. However, if you spent $3,500 on work-related expenses, your taxable income would be brought down to $61,500.

The extra tax you paid throughout the year would be returned to you.

Your refund would go from $1,133 to $2,393. Your deductions enable you to receive an extra $1,260, a portion of the $3,500 you spent.

How do I prepare for taxes when starting a business?

You won't have any tax instalments paid on your income during the year like you do with wages. Therefore, it is likely that you will have to pay taxes in a lump sum to the ATO when you complete your first tax return.

Pro tip: Put aside money throughout the first year to make sure you are prepared for this first bill.

The ATO will then, in most cases, send out tax instalments for you to pay each quarter in preparation for the next tax return.

What to expect if you have a lot of expenses in the first year

If you have a lot of expenses in the first year and hope to get a refund, this will not be the case if no tax has been paid during the year.

A tax refund is all based on the amount of taxes you paid in advance throughout the year.

The maximum tax refund you can get is all the taxes you’ve paid in advance for that year.

What are some common tax deductions I can include?

You can claim professional services fees such as marketing, advertising and promotions for your side business. Other tax deductions can include:

- Motor vehicle and car expenses: Petrol, oil, repair, road tolls, maintenance, purchase price or leasing

- Travel expenses: Bus, taxi, plane, ride share, car parking

- Clothing, laundry and dry-cleaning: Uniforms, safety gear, sunglasses, high-vis

- Self-education: Student fees, tuition fees, stationery and consumables, laptops

- Tools, equipment and assets: Computer, office furniture, tools of trade

- Union fees and subscriptions: Trade journals, licenses and permits

- Working from home: Home office running and occupancy expenses, phone, internet heating, cooling, gas, electricity

- Insurances: Public liability, work cover, personal indemnity

You can also include the cost of managing your finances and taxes. Not only do you get professional advice to steer you in a profitable direction, but you can also claim the fees, too.

What are some ways to reduce taxable income?

Do yourself a favour and start these habits right now — you’ll thank yourself at tax time.

- Log tax deductions into a software program as you receive them.

- Create a folder and start tucking important documents into it. This includes any receipts, tax invoices, and contracts related to your finances. The ATO will ask for proof.

- Only claim work expenses. If you’ve bought an item, or travel for both business and private use, then you’ll need to apportion the business costs only.

- Claim only incurred expenses. You can’t claim costs you haven’t paid yet, even if you know the expense is coming up.

Be on the lookout for grants, both federally and state based. Some grants attract personal income tax, while others are exempt.

Additional notes about website tax deductions

Because your website is a business tool, there are a range of tax deductions that can be claimed.

Costs associated with running and maintaining your website can be claimed in the year they occur. Keep the receipts for your:

- Domain name

- Registration fees

- Hosting expenses

Off-the-shelf software can be claimed in the year you bought it. Special rules apply if you acquire or develop your own software.

If you’ve paid for a new computer or laptop, you will need to depreciate the expense over a few years.

Any services associated with your web site can also be claimed. This includes:

- Graphic design

- Marketing promotions

- Advertising

- Any special licensing for fonts or stock photography you use

As a side note, beware of copyright on fonts and images before using them. Don’t be tempted to steal from Google or a free photograph site. Most of these are not regulated and can result in litigation.

If you’ve set up a banking system to an online store, you’ll be able to claim:

- Transfer fees

- Bookkeeping

- Banking transaction fees

You can also include any costs associated with banking and programming.

Editor’s note: Editor's note: Tell us about your idea and GoDaddy Airo will generate a domain name, logo, website, social media handles and more. All for the price of your domain name. Try it now!

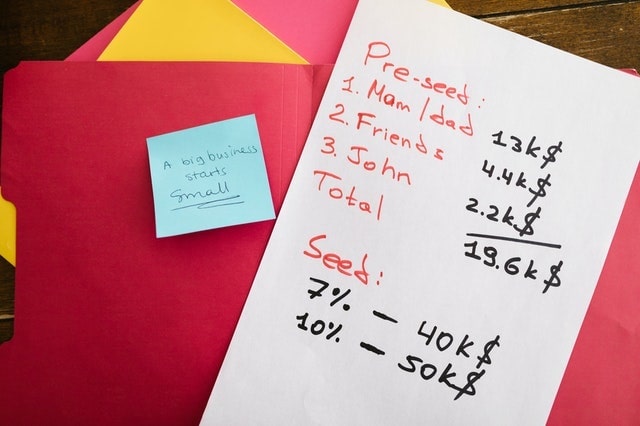

8. Plan your business

Learning how to start your side business is only part of the equation. Planning will help you prioritise your business goals. It will also give you control over your business and help you understand your financial commitments.

When planning, determine what start-up costs you’ll need to outlay or if you need to seek and apply for any loans.

Good planning will prepare you for an emergency, equipping you with the right tools you’ll need to respond quickly in dire situations. This is crucial for keeping your side business running efficiently and smoothly.

Marketing

You may have a brilliant idea for a side job, but if no one is willing to buy your products or services, then it might be best to shelve that idea and think of another one.

Understanding your target audience will go a long way to better focus your marketing efforts and spend your money wisely. You should also take time to:

- Know your competition

- Research how to attract customers

- Set goals and time frames

- Map out a strategy for marketing activities and how to evaluate them

It’s also a good idea to sketch out a marketing plan to help you:

- Define your product offering

- Clarify your strategy

- Crystallise your product or service

Remember, you’ll need to ‘know thy market’ if you want a successful side business.

Editor’s note: Eye-catching visuals are key to getting attention on social media. Use GoDaddy app to design high-quality images for social posts, infographics and more.

Digital presence

In today’s world, you’ll need an online presence on social platforms and a website. This can help you reach a wider customer base and create interest in your product or service. You can start by setting up social media accounts with your business name, where you can advertise your products, your brand, and even start selling. For a more targeted approach, check out our guide on how to sell on Facebook Marketplace to reach a broader audience and boost your sales.

You may need an online shop to sell your products or advertise your service.

Don’t forget to ensure you’re protected from cyber threats. Scammers love an easy target and if you’re not protected it’ll only be a matter of time before you’re targeted for malware.

It’s also important to protect your Intellectual Property (IP). Your IP could be your:

- Knowledge

- Name

- Creation

- Idea

Some forms of IP require you to formally apply and obtain a right to ownership.

In Australia, other forms of ownership such as copyright do not need to be registered. But this might not be the same if you sell into different countries.

You should consider applying for a patent if you’ve created a:

- Device

- Substance

- Method

- Process

Anything that is new, inventive and useful to your customers should be protected.

Insurances

Having the right business insurance will protect you and the following assets in case something happens:

- Your income

- Your business

- Your staff

- Your customers

Insurances can vary and will depend on the type of side business you start.

Some insurances are an Australian requirement and include:

- Worker’s compensation: This applies if you have employees and is compulsory for all businesses.

- Public liability: This covers you for third party death or injury and is compulsory for some businesses.

- Third party personal injury: This is compulsory if you own a motor vehicle and is often a part of your vehicle registration fee.

The essentials of earning on the side

Starting a side business is no small undertaking. Whether you’re doing it to save a little extra money or looking to own a small business, you’ll never look back.

Always be ethical and lawful with your business dealings.

Make sure you register your business correctly and abide by the following guidelines

- Trade fairly

- Offer contracts where required

- Operate under the latest privacy, employee and contractor laws

- Protect your intellectual property

If you’re importing and exporting, make sure you’re doing so ethically and under Australian lawful conditions. The Competition and Consumer Act 2010 regulates fair trading in Australia and governs how all businesses in Australia must deal with customers, competitors and suppliers.

While the Act is a national law, each state and territory also provide additional consumer protections within their own fair-trading legislation. Australian consumer law protects consumers of a product or service.

Key takeaways to help you succeed

Make sure you understand your customers first and foremost. You’ll want to offer the best products or services and consider employing professional help where you need it.

There are so many ways you can start a side job and you never know where you’ll end up. You might even get featured on the next episode of Shark’s Tank!

Frequently Asked Questions

What’s so great about starting a side hustle?

Side hustles are all the rage in Australia these days. In the current financial climate, it's easy to understand why, when some find it difficult to make ends meet with their regular income. Side jobs offer a way to earn some extra cash and cover rising expenses and cost of living.

They’re flexible. You can work on them part-time or casually and fit them in around your other commitments, whether that's your family, your studies or your full-time job.

Startup is fairly easy. The rise of easy website builders and eCommerce platforms make it easier than ever to start a side business. You can test out business ideas and gain experience before committing to a full-time venture.

Let's not forget the gig economy. Companies like Uber, Deliveroo, and Airtasker are giving people more opportunities to earn money on a casual basis. Side hustles can also offer extra income in the form of freelancing services such as graphic design, writing or photography.

How will my taxes be affected?

Your mind is probably zinging with a thousand side hustle ideas. The last thing you want to think about is how it will affect your tax — after all you just want to earn some extra cash.

That’s totally understandable. However, if you can put some plans in place, it might save you a few headaches later on when it comes to working out your tax obligations at tax time.

The Australian Taxation Office (ATO) sees no difference with how you earn an income. It’s only concerned with your total amount of income earned, which might mean you’re hit with a bigger tax bill than you expect simply because you’re earning more. Ouch.

Don’t let the thought of paying tax put you off. There are some bonuses for the savvy side-hustler to be aware of.

Tax Deductions

The first thing to understand is what tax deductions you can claim to lower your overall tax bill.

When you work a side hustle, you’ll have extra expenses, which can be claimed on your return. You'll only pay tax on the difference between your income and deductions.

So, it's crucial to claim all your business expenses, whether that's:

- Buying stock

- Heating your office

- Promoting your services

- Travelling to meet customers

But before you start claiming deductions left and right, there are some rules you need to know. For one, the expense must be related to your business and not private or domestic in nature.

Unfortunately, that means you can't claim your weekly groceries or household bills as deductions. And if an expense is partly related to your business and partly private, you'll need to apportion it accordingly.

Pro Tax Tip: You can claim the cost of setting up and maintaining your web site, including the cost of the domain registration, website hosting, website design and development, maintenance and updates when your side-hustle is generating an income.

How do tax deductions work?

Tax deductions work by reducing the amount of income you're taxed on. In Australia, you're taxed on your taxable income, which is calculated by subtracting your deductions from your total income.

So, for example, if your total income for the year is $80,000 and you have $10,000 in deductions, your taxable income would be $70,000. You would then pay tax on that amount, rather than on the full $80,000.

Your claimable expenses are typically divided into two categories: work-related expenses and personal deductions.

Work-related expenses are costs you must pay as part of doing your job. They can be tax-deductible if you paid for them out of your own pocket and they were necessary for you to perform your job.

Some examples of work-related expenses include:

- Logoed uniforms or protective clothing

- Tools and equipment

- Travel expenses

- Self-education expenses

- Working from home expenses

If you're running your side hustle from your home, you may be able to claim tax deductions for certain expenses related to the business portions of your utility bills, phone bills and internet costs.

Additionally, if you have a dedicated business space in your home, such as an office, you may be able to claim a proportion of the mortgage interest and rates as a tax deduction.

Personal deductions, on the other hand, are expenses that aren't directly related to earning income but can still be tax-deductible under certain circumstances. Examples of personal deductions include:

- Charitable donations

- Personal superannuation contributions

- Tax agent fees

Pro Tax Tip: You may be able to claim tax deductions for preparatory work if you're thinking about starting a side hustle. This includes activities like conducting feasibility studies, doing market research, creating a business plan and seeking advice on the right structure for your business.

What are the working from home rules?

There are two main methods for claiming working from home expenses: the Fixed Rate method and the Actual Costs method.

Fixed Rate method

Under the Fixed Rate method, taxpayers can claim a fixed rate of 70 cents per hour in 2024-25 to cover electricity, heating, cooling, lighting, phone, internet, computer consumables and stationery.

This means that the 70c per hour is used instead of claiming the above expenses separately and will save on paperwork. A diary recording the actual hours worked from home is required for this method, as well as one monthly or quarterly bill for any of the above expenses.

A separate claim can be made for business assets such as a:

- Computer, iPad or similar electronic devices

- Desk, office chair and office furniture

Some items may need to be depreciated over a number of years. You can also claim any repairs or maintenance costs of these assets.

Actual Cost method

Alternatively, you can choose to use the Actual Costs method, which involves keeping records of all expenses incurred while working from home and claiming a proportion of those expenses that are work-related.

A four-week representative diary of hours spent working is required for this method, as well as calculations on how the business portion was arrived at.

Pro Tax Tip: If you're looking to improve your side-hustle business skills, you may be able to claim a tax deduction on expenses such as courses, training, seminars, and conferences, as long as they're directly linked to your business income and were incurred while the business was producing income and not before.

It's a great way to invest in yourself and your business while also receiving a tax benefit.

Is a side job a business or a hobby?

You’ll need to decide if your side hustle is a hobby or a business. If the ATO doesn’t think you’re running it as a business, you won’t be able to claim any tax deductions.

According to the ATO:

- A business is any activity you do to make money

- A hobby is something you do for fun or personal enjoyment with no intention of making money

The main difference between the two is that a business is typically commercial and carried out in a systematic and organised way to make a profit. A hobby is more casual and not usually focused on making money.

When deciding whether an activity is a business or a hobby, the ATO takes into account various factors such as the size and nature of the activity, your intentions and the likelihood of the activity making a profit.

Am I required to register my side job?

You may enjoy working your side hustle, but you’ll still need to register it if you’re running it as a business (i.e., to make profit).

So, what do you need to do first to become a legal trading entity?

If you want to register a business and get an Australian Business Number (ABN), you'll need to follow a few steps.

- First, you'll need to decide on the structure of your business, whether it's a sole trader, partnership, company or trust.

- Once you've decided on the structure, you'll need to choose a business name and check if it's available. You can do this by searching the Australian Securities and Investments Commission (ASIC) database. If the name is available, you can then register it. If you decide to operate under your own personal name as a sole trader, no business name will need to be separately registered.

- Next, you'll need to register for an ABN. You can do this online through the Australian Business Register (ABR) website. To register, you'll need to provide details about your business, such as its structure, business name and address. If using your personal name as a sole trader, this will become your business name.

In some cases, you may also need to register for other business taxes, such as goods and services tax (GST) or Pay As You Go (PAYG) withholding. You can do this through the ABR website as well.

Once you've completed these steps, you'll be registered as a business in Australia and will have your own ABN.

Pro Tax Tip: Registering your business and obtaining an ABN doesn't automatically mean you have all the necessary permits and licenses to operate your business — such as a food or liquor license — so make sure to check the requirements for your specific industry and location.

Who needs to register for GST (goods and services tax)?

Does your side-hustle earn over $75,000? First of all — good on you! It takes a great deal of effort, skills and talent to get that far.

Don’t forget that once your business is earning $75,000 and over annually, you’ll need to register and collect the goods and services tax (GST).

The GST is a 10% tax applied to all your taxable sales, which you'll need to pay to the Australian Taxation Office (ATO) every three months through your Business Activity Statement (BAS).

The good news is that you can reduce the amount you owe by claiming back the GST credits paid on your expenses and purchases, and only pay GST on the difference.

Got any other tax tips for a side hustler?

Here are some tips that can help you stay on top of your tax obligations and avoid penalties:

Keep accurate records. Make sure to keep all receipts and documents related to your income and expenses. This will help you prepare your tax returns accurately and also serve as evidence in case of an audit.

Know your deadlines. It's important to know when your tax returns are due and make sure you file them on time. If you miss the deadline, you may face penalties and interest charges.

Seek professional advice. If you're unsure about your tax obligations, it's a good idea to seek advice from a tax professional. They can help you understand the rules and regulations and ensure you're complying with them.

Understand deductions. Make sure you understand what deductions you're eligible for and keep records of them. This can help reduce your taxable income and ultimately how much you owe.

Stay organised. Being organised can help you stay on top of your tax obligations. Set up a system for keeping track of your income and expenses, and make sure to review it regularly.

Set up two business bank accounts. Your business should have a separate bank account to record all your business income and expenses. Do not use this account for private transactions.

Set up a second account to put aside money for tax obligations.

- If you are registered for GST, put aside 10% of your net income to cover the BAS.

- You should also put aside 20% of your net income to cover possible income tax obligations. This will vary depending on what other wage or investment income you may have outside of your side business.

What are the most important things to remember about tax deductions?

The ATO has three golden rules that everyone should keep in mind when it comes to claiming tax deductions. These rules are pretty important, so it's a good idea to familiarize yourself with them if you're running a side hustle.

- The first rule is to keep accurate records. This means keeping track of all your income and expenses, along with any receipts, invoices and other documents that you might need to prove your deductions or other claims.

- The second rule is to declare all your income. This might seem like a no-brainer, but some people try to hide income or leave it off their tax returns. This is a bad idea because the ATO has ways of finding out about unreported income, and the penalties can be severe.

- The third and final rule is to claim only what you're entitled to. This means taking advantage of all the deductions and credits that you're eligible for, but not trying to claim things that are really personal costs.

Who should consider a side hustle?

Think about your motivation for starting a side hustle. Is it to make some extra money to supplement your income, or are you hoping to eventually turn it into a full-time business? Understanding your goals can help you determine if a side hustle is a good fit for you.

- Consider your available time and resources. Do you have enough free time outside of your regular job and other commitments to dedicate to a side job? Are you prepared to invest the time and money into getting it off the ground?

- Do you have the skills and knowledge required to succeed? If not, are you willing to spend time in developing those skills?

- It's important to assess the potential risks and rewards of starting a side hustle. Are there any legal, financial or taxation risks involved? Are you prepared to take on those risks? On the other hand, what are the potential rewards, both financially and personally?

It’s up to you to decide if a side hustle is for you, but you don’t have to go it alone. There are ways to make the journey a little easier and to ensure the best possible results.

Consider reaching out to professional who will help you set your side-hustle up the right way from the get-go. A bonus of reaching out for help is that these professional services are claimable tax deductions once you start earning an income.