To build a sustainable, profitable, scalable ecommerce business this year, you need to understand the ins and outs of managing inventory. Poor inventory management can be a complex challenge to overcome for any ecommerce entrepreneur, no matter your expertise, the size of your business, the types of products you sell, or the audience you serve.

As the year progresses and you work through plans for launching a new ecommerce business, you’re likely thinking a lot about how to approach and optimize inventory management.

Making the wrong choices when it comes to how you manage inventory can be incredibly costly. Making the right choices can be incredibly profitable.

So, what do you need to know to be successful in the year ahead?

This article will provide you with a brief overview of inventory management. First, we’ll highlight a few terms you need to know, then we’ll detail some of the challenges that ecommerce business owners face, and finally, we’ll wrap up by providing you with a handful of actionable best practices and recommendations that you can use to build or optimize an effective inventory management strategy for your business.

Also, if you’re looking to launch a new ecommerce venture, consider WordPress + WooCommerce for your new eCommerce website.

Glossary of inventory management terms

Before we dive too deep into how to optimize inventory management, it’s helpful to first understand some of the terms and concepts that you’ll encounter along the way. Here’s a list of 20 words and phrases to become more familiar with:

- Inventory: tangible items, products or goods that you intend to sell to customers.

- SKUs: a stock-keeping unit (SKU) is an identification code that you use to classify and organize products.

- Variants: variations of the same product, such as different colors.

- Units of measure: whatever you use to measure your stock (items, pieces, bundles, kilograms, ounces, etc.).

- Supply chain: the processes and systems involved in producing, managing and distributing products.

- Deadstock: inventory that you have in stock but can’t necessarily sell anymore.

- Buffer stock: the amount of extra stock on hand that’s used to limit the risk if supply and demand are uncertain.

- Minimum viable stock: the minimum amount of product you need to have on hand to keep up with consumer demand and fulfill orders without delay.

- Reorder point (ROP): the pre-determined level to which inventory must drop before ordering additional inventory.

- Lead time: the time delay between when inventory is ordered from a supplier and when it arrives.

- ABC analysis: a method for prioritizing your existing inventory using three categories: (A) high-value products with a low frequency of sales; (B) moderate-value products with a moderate frequency of sales; (C) low-value products with a high frequency of sales.

- First in first out (FIFO): Investopedia defines FIFO as an “an asset-management and valuation method in which assets produced or acquired first are sold, used, or disposed of first.”

- Just-in-time (JIT): a fulfillment method where inventory orders are made just in time to keep up with demand from consumers. This method allows you to avoid tying up money in unsold inventory but creates potential risk of not being able to fulfill a sudden surge of orders.

- Dropshipping: a fulfillment method where you don’t actually store any inventory onsite. Instead, orders are fulfilled, and inventory is shipped directly from a third party to the customer.

- Centralized inventory control: software that allows you to easily manage, track and control inventory across multiple ecommerce websites like Amazon, eBay and Etsy.

- Inventory management software: tools that help you track inventory, streamline processes, automate tedious tasks, and leverage data and other insights to boost success.

- Cost of goods sold (COGS): your cost of production. (This is especially important from a tax perspective.)

- Carrying cost/holding cost: the cost of holding your inventory in a year versus the value of the inventory itself.

- Inventory auditing: the act of manually counting or checking inventory to ensure that it matches the numbers that exist within your tracking and automation systems.

- Inventory forecasting: making informed decisions about ordering and reordering products based on historical data, trends and seasonality in your business.

Understanding these terms and concepts will ultimately help you become more informed and strategic when it comes to managing and optimizing inventory management processes and tasks at your business.

Challenges with inventory management in ecommerce

Every ecommerce business owner encounters inventory management challenges at one point or another. Knowing what some of these challenges are ahead of time and how to address them are what separates good inventory management from great inventory management.

Here are some of the most common inventory challenges that can ultimately affect the growth and profitability of an ecommerce business as well as customer experience and retention:

Challenge #1: Overstocking & overselling

In ecommerce, a good grasp of your inventory and the shopping habits of your target audience will help you accurately stock and sell your products. If you underestimate your customers’ needs, your supply may not meet demand. If you overestimate how much product you need, you’re likely to spend more than you make.

Although it can be advantageous to keep a large supply of inventory on hand, especially as you approach a busy season, it can present some challenges:

- It can be expensive. Unless you’re dropshipping inventory, you’ll need to store the products you order from manufacturers. As you can imagine, too much inventory and not enough orders can wreak havoc on your ability to come out ahead at the end of the month.

- There’s potential for having too much dead stock on hand. As mentioned earlier, deadstock refers to inventory that you basically can’t sell because you have too much inventory and not enough demand. It happens when products perish or deteriorate over time, but it can also happen as trends and shopping behaviors shift.

On the flip side, not having a good pulse on your inventory can result in accidental overselling — i.e., letting customers buy products that are out of stock. When you oversell a product, you create customer service and reputation challenges that can take time to overcome and repair.

These days, consumers want transparency when it comes to working with ecommerce brands. They want to be able to know and trust that if you make a promise, you’ll keep your word. When you oversell inventory, you risk delaying fulfillment and potentially damaging the trust you built up with people who chose to order your product. A quick fix for this would be to flag products as in or out of stock online so customers can see available quantities for themselves.

Challenge #2: Manual management that doesn’t allow for scale

Another inventory management challenge that many ecommerce business owners face relates to scale. When you’re in the early stages of building your ecommerce business, it’s relatively easy — and tempting — to manually track and fulfill orders, even across multiple channels. But it becomes much more difficult as you work to scale your business to meet the growing demands of your customer base.

For many ecommerce business owners, scaling means selling products on additional channels, such as Amazon, Etsy, eBay and Alibaba. It also means working with multiple partners, vendors and manufacturers. It might even mean storing inventory at multiple warehouses around the country.

Taking such steps to grow your ecommerce business in this way is next to impossible when you rely only on manual management methods. With manual management, you also stand the chance of encountering data mistakes that affect inventory management. For example, this could lead to overestimating or underestimating the inventory available to customers.

Some examples of ineffective manual inventory management methods include:

- Using offline spreadsheets to track inventory numbers

- Using a suite of separate tools that aren’t integrated or synced with each other

- Using an offline program that can’t provide you with automatic real-time updates

- Using paper and pencil to manually track and fulfill orders

When you’re just starting in the world of ecommerce, it can be tempting to track and manage inventory manually to save money and keep a hand in every aspect of your business. To avoid and prepare for some of the challenges mentioned above, however, you must take the time to investigate and make plans to adopt more scalable inventory management processes, tactics and tools that support continued growth over time.

Challenge #3: Lack of visibility across multiple channels & multiple warehouses

Lack of visibility is another common problem that ecommerce business owners tend to face as product demand increases and inventory management becomes more complex. There are two main visibility challenges that can impact your ability to meet demand and grow your business:

- Lack of visibility across multiple channels. As mentioned above, as you grow your ecommerce business, you’ll likely decide to start selling your products across multiple channels (Amazon, Etsy, eBay, etc.). The problem is unless you’re using inventory management software, it’s not always easy to keep track of the sales and orders that come in from each channel and how those sales and orders are impacting the inventory you have on hand.

- Lack of visibility across multiple warehouses. As your business grows, you might find yourself partnering with more manufacturers and warehouses to meet the growing demands of your customers. Your goal is to have inventory on hand and accessible when demand suddenly increases. But again, without inventory management software in place, trying to keep track of orders, inventory and relationships across all warehouses, partners and manufacturers can be a dizzying process for anyone.

[Source]

Without complete visibility across your entire inventory management system, it’s difficult to know which decisions need to be made and by when they need to be made to continue boosting sales and meeting consumer demand.

Also, keep in mind that a consistent brand experience across channels is key to maintaining customer satisfaction. For example, pricing and product availability should be monitored and adjusted uniformly across all channels.

Challenge #4: Lack of insights

The final inventory management challenge that many ecommerce business owners face is a lack of data insights. Data and data analysis will help your company find areas of improvement that can lead to an increase in your engagement and revenue.

To boost profits, support growth, and cater to the needs of your customers, use data to help you understand how your inventory is fluctuating over time and how demand is changing over time. Your insights can aid in forecasting what your inventory should look like in the future when to reorder products, when to scale back on products and where breakdowns in your processes are happening.

Oftentimes, you need to be able to access and act on inventory data within a day or even a few hours to capitalize on or fully understand an emerging opportunity.

Without a centralized system that pulls inventory information from every source on a real-time, 24/7 basis, it’s virtually impossible to leverage data to make these kinds of informed decisions about your business.

Getting started with inventory management

Now that you understand some of the concepts and challenges relating to inventory management in ecommerce, it’s time to take action. To build an optimized inventory management system for your ecommerce business, take the following steps:

1. Understand basic product category demand

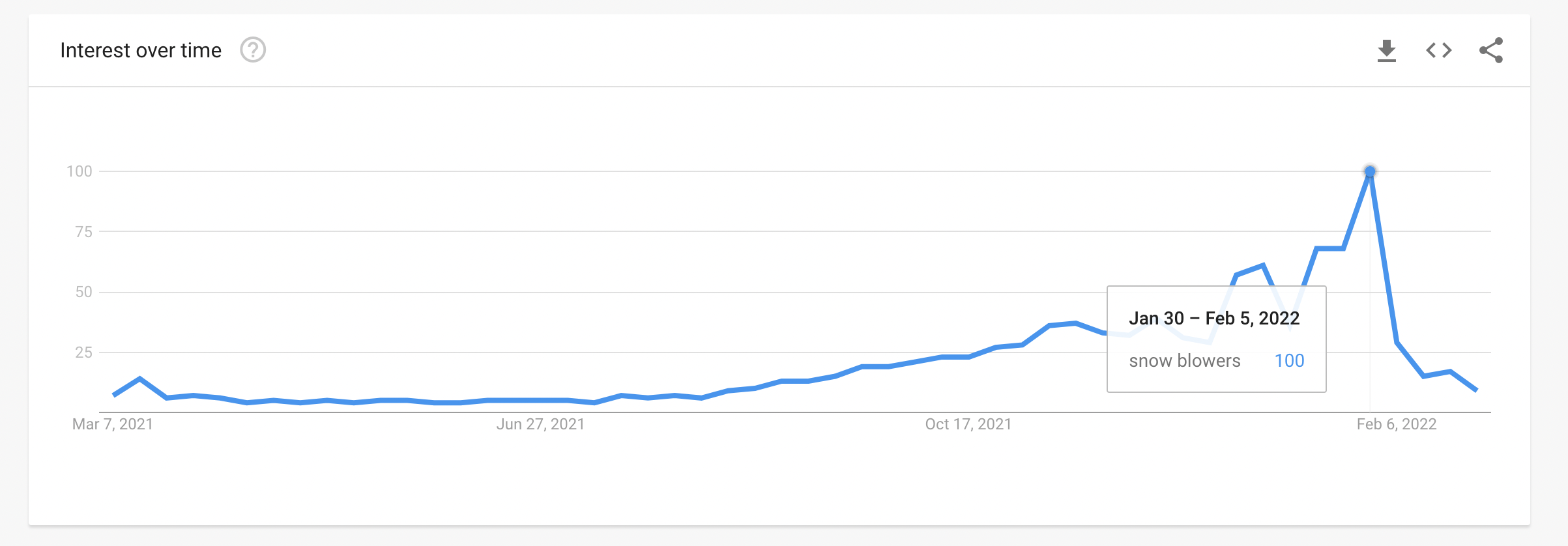

The first step in getting a better handle on inventory management, especially if you’re launching a brand-new ecommerce shop, is to understand how demand fluctuates for your product category over time. You can achieve this by using Google Trends to look at how search demand and interest have changed over the past 12 months or even the past five years.

Here’s a dramatic example showing when people are searching most often for snowblowers throughout the year:

[Source]

As you can see, interest begins to grow as early as October 2021 and peaks between January to February 2022. By understanding trends in this way, you can gain a better understanding of when you might want to order more or less of the products you sell.

If you have an established ecommerce site, another option is to use Google Analytics to see which pages and products your audience visits the most and how long they spend there. This insight will not only tell you what types of products attract your audience’s attention but also which products are popular and require more buffer stock.

2. Forecast future demand based on past sales

The second step in optimizing inventory management is to attempt to forecast future demand — including seasonal demand. To do this, simply look at past sales and determine when demand and interest were highest. Also, look ahead to find major selling opportunities throughout the year — like holidays and events — and plan for increased demand.

From there, order and store inventory accordingly to prevent any items from going out of stock during peak demand times. If you don’t have any sales history, refer back to the analysis you performed with Google Trends and Google Analytics.

3. Set initial minimum viable stock or minimal stock levels

If your ecommerce shop is already running, you should also take the time to set minimum viable stock levels for every product you sell. Remember: your goal is to determine the lowest possible inventory you can have in order to meet demand and avoid delays in fulfillment.

To land on your number, you’ll need to have a good understanding of demand and the amount of time it takes to replace out-of-stock inventory. When quantities dip below the number you designate, place a new order with your manufacturer or wholesaler. Think of this exercise as a starting place. Don’t be afraid to adjust this number over time as you experience growing or waning demand from consumers.

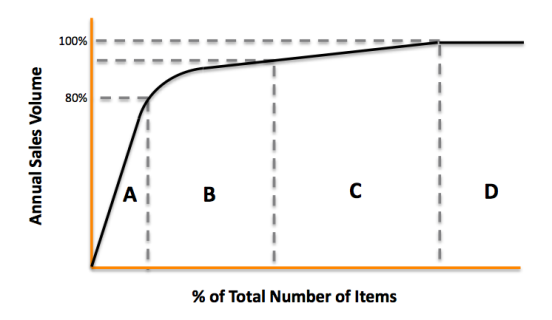

4. Prioritize products with an ABC analysis

To boost efficiency and save money, take the time to prioritize products using the ABC analysis. The ABC analysis is a method for prioritizing your existing inventory using three categories:

- (A) high-value products with a low frequency of sales. For example, big-ticket items like workout and sporting equipment.

- (B) moderate-value products with a moderate frequency of sales. For example, electronics and jewelry.

- (C) low-value products with a high frequency of sales. For example, clothing and food.

[Source]

ABC analysis is based in part on the Pareto Principle, which explains that 80% of your sales can be attributed to 20% of your customers. These customers buy category A products, which account for the majority of your revenue. Therefore, it’s more costly to your bottom line to lose these customers than it is to lose customers who buy category B and C products.

Your goal here should be to understand which products need the most attention from an inventory management perspective. For example, products that fall under your A category (the highest-selling products) may need to be ordered more often than products that fall underneath your C category (the lower-selling products).

5. Gear up for seasonality

If you’re running an ecommerce store that will take advantage of a particular shopping season — like holidays — or time of year — like summer — do what you can to be prepared.

Keep inventory levels low during slow months, but don’t wait too long to ramp up your supply. Near the end of a peak season, promote special offers to sell off the majority of inventory to avoid carrying too much dead stock.

Keep your operating costs down for as long as you possibly can, and while business is slower, use the time to make sure you have all the pieces in place — like partners, tools, warehouse storage, people resources, etc. — to ensure a smooth and successful sales period.

6. Implement inventory management software

To build and scale an ecommerce business today, invest in inventory management software. You can manually work through some of the tips outlined above, but using software will help maintain accuracy while saving you time and money.

The benefits of inventory management software include:

- Helping you keep a pulse on inventory

- Ensuring you’re never overstocked or understocked

- Syncing inventory tracking across all the channels on which you sell products

- Compiling real-time inventory data within one convenient system

- Leveraging valuable insights

With more time and data added to your business, you can take advantage of new product opportunities, boost sales and successfully grow your ecommerce business.

Think about your inventory management strategy

As you think about improving inventory management for your ecommerce business, there are a few questions to ask yourself. How do you approach inventory management at your business? What challenges have you faced and been able to overcome? What have you learned that might help other entrepreneurs and business owners?

The answers to these questions will inform how you implement inventory management, how your business grows, and how you continue to meet the needs of your customers.