While working for an employer, you don’t have to worry about business finances. Bosses take care of taxes, expenses, insurance and other seemingly complex monetary concerns. But all of that changes when you become a freelancer. You become responsible for managing money and not making freelance financial mistakes.

While it might seem intimidating at first, it’s not difficult to avoid freelance financial mistakes. You just need to look out for the right things.

Disclaimer: This content should not be construed as legal or financial advice. Always consult an attorney or financial advisor regarding your specific legal or financial situation.

Avoid these 8 freelance financial mistakes

As a new solopreneur, you can avoid the top freelance financial mistakes by being aware of potential problems from the beginning and setting up systems and solutions to stop errors before they happen.

-

Not tracking business expenses.

-

Not keeping receipts.

-

Not monitoring contractor expenses.

-

Not putting money aside for taxes.

-

Not paying yourself a salary.

-

Not getting health insurance.

-

Not putting money into retirement.

-

Not planning ahead.

Ready? Let’s go over the top freelance financial mistakes that new solopreneurs make — and how to avoid them.

1. Not tracking business expenses

When you are self-employed, you can deduct certain business expenses which can decrease the amount of taxes you owe. So it’s important to keep track of all of the purchases you make related to your business.

All freelancers should use an accounting or online bookkeeping software to track expenses associated with their business. Expenses and deductions that many freelancers forget to track include the following:

- Home office expenses

- Mileage and gas

- Professional development

- Retirement contributions

- Insurance premiums

By tracking your expenses from the get go, you’re saving yourself hours and hours of heartache down the line. You’ll be much better prepared for tax season if you set up solid bookkeeping software and keep accurate records.

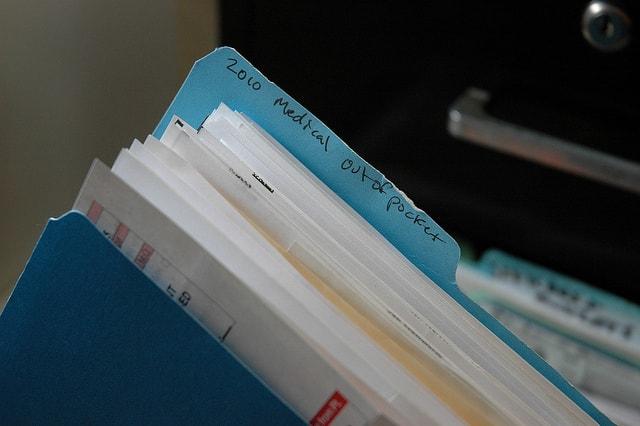

2. Not keeping receipts

As you start tracking business expenses and deductions, it’s important to keep receipts that show proof of your purchases. Keeping records helps your accountant or bookkeeper in the event that they need to cross-reference your expenses. Your records will also be very important if you are audited by the IRS.

Keep a paper file folder of all print receipts, and create a digital folder for any online purchase receipts to keep your information organized.

3. Not monitoring contractor expenses

While tracking expenses, you should pay close attention to the money you pay out to contractors. If you work with other freelancers, you must provide a 1099-MISC to the IRS if you pay the freelancer more than $600 per fiscal year.

So if you use contractors, don’t make this freelance financial mistake. Collect W-9s from new contractors and submit 1099s when necessary.

4. Not putting money aside for taxes

One of the biggest freelance financial mistakes is looking at a check for $1,000 and seeing it as a $1,000 bump for your checking account. Freelancers always need to automatically consider a percentage of all income as gone and going to taxes.

When you get paid, set aside about 30 percent for business taxes.

Better yet, set up estimated payments through the IRS so you can pay quarterly estimated taxes and avoid getting hit with a big tax bill at the end of the tax year.

5. Not paying yourself a salary

Another freelance financial mistake that is easy to make when receiving payment from clients is depositing all of the money right into your spending account. Even if you take out 30 percent for taxes, you shouldn’t consider the rest of the funds as income that you can spend.

Instead, to avoid this freelance financial mistake, manage your money and treat your business income like profit. And then, pay yourself a set salary.

- To treat income as a profit, deposit all business income into a business bank account.

- Decide how much you want to pay yourself and how often.

- Take the set amount of money out of your business bank account and deposit into your personal account on the set date.

This helps you manage your income, avoid spending all of your money on busy months, and provide padding for slower months.

6. Not getting health insurance

Freelancers, especially new freelancers, want to get to work doing the tasks they know and love — not deal with health insurance plans and premiums. But part of being a successful solopreneur is setting up and managing a health insurance plan for yourself.

While the expense of paying for health insurance might seem high, it is nothing compared to the financial woes you could find yourself in if you get sick without coverage.

So protect your health and your finances. Use an independent health insurance broker, healthcare.gov, or the Freelancers Union healthcare resource to explore your options and find a plan that’s right for you.

7. Not putting money into retirement

When you’re just starting a freelance business, it can be difficult to look at the long term. You can get caught up in making sure your finances work for you now. But one of the biggest freelance financial mistakes is not looking into the future and setting up a retirement account.

Saving for the future should always be a part of your financial plan.

Even if you are setting aside only a $100 a month, it’s better than nothing. Start early, set up an IRA, and make it a part of your process from the early days to ensure you are prepared for the future.

8. Not planning ahead

Usually, the biggest freelancer financial mistakes arise from not planning ahead. So use the tips in this post to plan and prepare for the future. Implement these processes and also set up a financial emergency fund that you can pull from if you need it.

Being prepared will always be the best way to avoid freelance financial mistakes and ensure that your new business is a success.

In conclusion

So there you have it, eight freelance financial mistakes you can avoid to start off your freelance business on the right foot. For more tips on how to start your freelance business off on the right foot, check out “Do these 11 things before you start your freelance business.”