Denise Larell was always a good student and a great hair stylist. She started making extra cash braiding hair at the age of 16. But two years later, struggling with realities of life under the poverty line, she was forced to make a tough choice, and temporarily dropped out of school to focus on making money. “I was in survival mode,” says Larell, who grew up in an economically distressed part of Baltimore. “I needed a source of income to provide for myself and my siblings,” she recalls.

Ten years later, Larell is no longer in survival mode. Thanks to her natural talent and hard work – she went to cosmetology school, took online courses in entrepreneurship, and went back to school to earn that high school diploma – she’s built a lifestyle she once could not have imagined as owner of Denise Larell Hair Studio. Charging up to $800 to do stunning hair extensions, she gives seminars around the Southeast United States and has extra time to mentor other would-be entrepreneurs. “I love that I can get up and go where I want,” says Larell. Having just arrived home from a Mexican vacation, she adds: “I want to use my revenue to see the world, so I can learn more.”

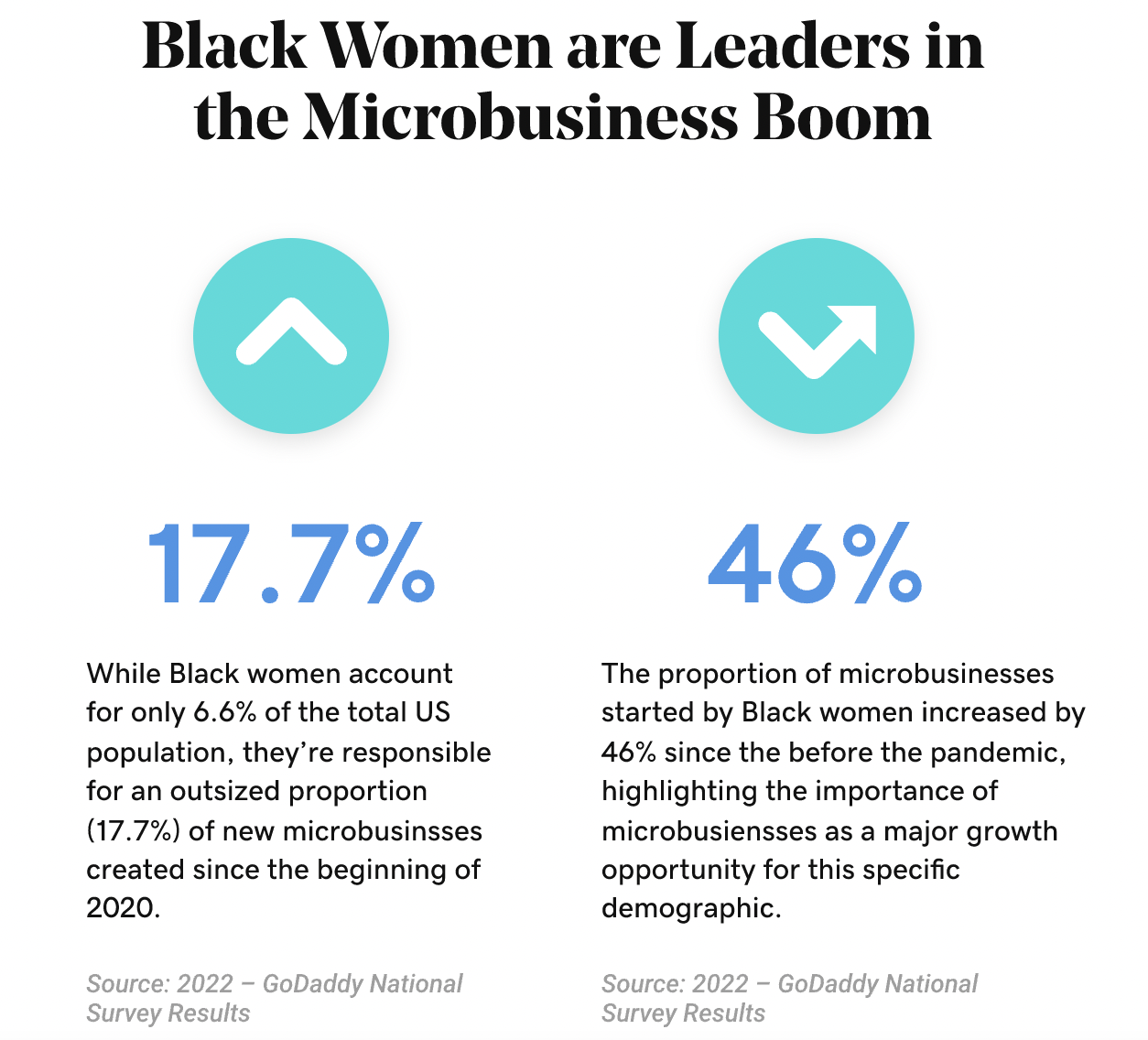

Larell is one of many Black women who have chosen to forge their own economic path in recent years by starting microbusinesses, loosely defined as entities with fewer than ten employees that have some kind of web presence. While Americans of all stripes have created millions of these businesses, no major demographic group has embraced the trend as much as Black women.

According to the most recent survey by GoDaddy’s Venture Forward initiative, collected in February, Black women have started 17.7% of all microbusinesses created in the U.S. since the beginning of 2020. That’s well above their 6.6% share of the U.S. population, and 46% higher than before the pandemic.

Determination to fight the odds

Of course, not all Black women face the huge obstacles that Larell has overcome. But as a demographic category, they do stand out in statistically meaningful ways. They are far less likely to be able to commit themselves full-time to their microbusinesses. In the recent survey, 60% of Black women founders said they had full-time jobs outside of their microbusiness, compared to 36% of founders from other groups.

Yet despite these headwinds, 92% of Black female founders were more optimistic about the next 3 months, compared to 72% of other founders who were surveyed. While they are more likely to run their microbusiness to bring in income to supplement a full-time job (48% for Black women, versus 40% of all others), they are far more likely to want to make it their primary source of income (83% for Black women versus 67% of all others).

And while 71% of Black female microbusiness owners are solopreneurs, compared to 58% for all other demographics, a higher percentage hope to build a large business.

In fact, 93% plan to grow the business in the next year, compared to 76% of other founders.

Increasing rates of business formation by Black females bodes well for the communities where they live. Three years of research by Venture Forward indicates that communities with a higher density of microbusinesses have lower unemployment and higher average household income levels. “This data is promising in terms of the likelihood of a more inclusive, equitable recovery, but also in terms of bringing in people with new ideas and innovations,” says Karen Mossberger, a professor at Arizona State University and a Venture Forward research partner.

“Women are paid less than men, and black employees are paid less than other racial groups, so Black women have long faced a double wage gap,” says Mossberger. “Starting a microbusiness is a way for people to take their future into their own hands, to see what they can do on their own.”

Finding a path forward

The recent survey results were gathered before new interest rate increases and other macroeconomic clouds appeared, but one trend is clear: Black women were hit inordinately hard by the economic fall-out from the pandemic. No major demographic group suffered more job loss since the pandemic began.

Even so, the Venture Forward survey and other studies suggest the rise in businesses started by Black women is not just about economic necessity. According to one 2021 survey by Catalyst, an advocacy group for women in business, one-third of women of color who were currently employed planned to leave their employers in the next year. The top three reasons cited were burnout (51% of respondents), a desire for a different career with greater purpose (47%) and better pay and benefits (47%).

Venture Forward data suggests that Black women can expect less financial help in pursuing their own course. Black women have far less access to capital. Only 2% of respondents had a bank loan, compared to 6% of all respondents, and 78% of Black women funded their start-up from personal savings, versus 67% for others. Not surprisingly, they tend to do more with less money. Nearly three quarters of Black female founders spent less than $5,000 to get their business up and running, versus 58% of others.

Photo: Kat Hernandez, Founder, Juanita’s Plants

Kat Hernandez exemplifies the experience of many lower-income Black women. As the daughter of immigrants from the Dominican Republic, she was unaware of the importance of credit scores growing up in Brooklyn. In part because they only spoke Spanish, her parents never had the opportunity to get a mortgage or a bank loan. It was only after she founded Juanita’s Plants that she applied for a bank loan, and was sorely disappointed to find that she couldn’t even get approved for a credit card. Part of the problem is she’d incurred $50,000 in college loans to get a journalism degree from CUNY-Hunter College, only to find out after the fact how it would hamper her ability to build a business. “It was only then that I learned that credit matters,” she says.

Growing businesses even when access to capital is scarce

The rules around the Payroll Protection Program also worked against her, since it was designed for businesses that had employees – not those created during the pandemic that were trying to hold on and survive. “Yeah, I would say it’s been challenging,” says Hernandez, whose only outside capital has been a $2,000 loan from her grandfather to fund a photo shoot for her website. While many factors determine business success, the lack of access to capital is one reason only 12% of microbusinesses owned by Black women bring in $4,000 or more per month in revenues, compared to 27% for other groups.

Hernandez remains undeterred, however, and has no regrets about joining two demographics with an outsized impact on the growth of the microbusiness economy: women of color and people under 30. By combining revenue from Juanita’s Plants with producing podcasts, she feels more in control of her economic destiny than if she were working full-time for someone else. “People like me are very much at a disadvantage when it comes to financing, but I’m going to do my thing, regardless of the adversity.”

The same goes for Larell, the hair stylist. She also built her business as she went, with no outside financial assistance or loans. In fact, she prospered during the pandemic, when she began producing wigs for clients and hosted a series of live online seminars. Now, she’s leveraging her growing brand recognition with an online course so she can earn revenue off her knowledge rather than her time. “I no longer want to trade my time for money,” she says.

Longer term, she hopes to open a chain of salons, where other stylists can rent a chair to start establishing themselves – just as she did in her late teens. “I’m living proof that you can do anything you put your mind to,” she says. “There’s nothing wrong with having a 9-to-5 job, but if you are called to do your own thing, you can do it.”