Getting paid for your goods or services on time is essential to keeping your business happy and healthy.

Whether you sell novelty skiing goods, you’re a creative freelancer — or anything in between — understanding invoices will keep your cash flowing and your financial affairs in order.

Getting started with invoices can seem daunting at first, but this in-depth guide on the subject will help.

Disclaimer: This content should not be construed as legal or financial advice. Always consult an attorney or financial advisor regarding your specific legal or financial situation.

What is an invoice?

An invoice is an official document used by all business owners that list their goods or services and the amount a client or customer owes them for the delivery of said goods or services.

Invoices are known as transactional documents because they are a formal way of requesting payment. By raising and filing invoices fluently, you’ll ensure that your business’s cash flows.

It lists the products or services, quantities, agreed prices, payment terms, and preferred payment methods. Invoices can be sent either electronically or on paper.

The importance of invoicing in business

In addition to getting paid on time, invoices are also essential for keeping track of your income.

So, not only do you need invoices to ensure a steady flow of income from your customers or clients—you also need them for keeping efficient tax records—and having an official paper trail in the event of a tax audit.

Business invoices are also vital for:

- Marking the sale or delivery date of goods or services

- Tracking the outstanding balance that a client or customer owes you

- Analyzing your business’s performance over certain timeframes

- Filling out your annual tax returns accurately

The key components of an invoice, explained

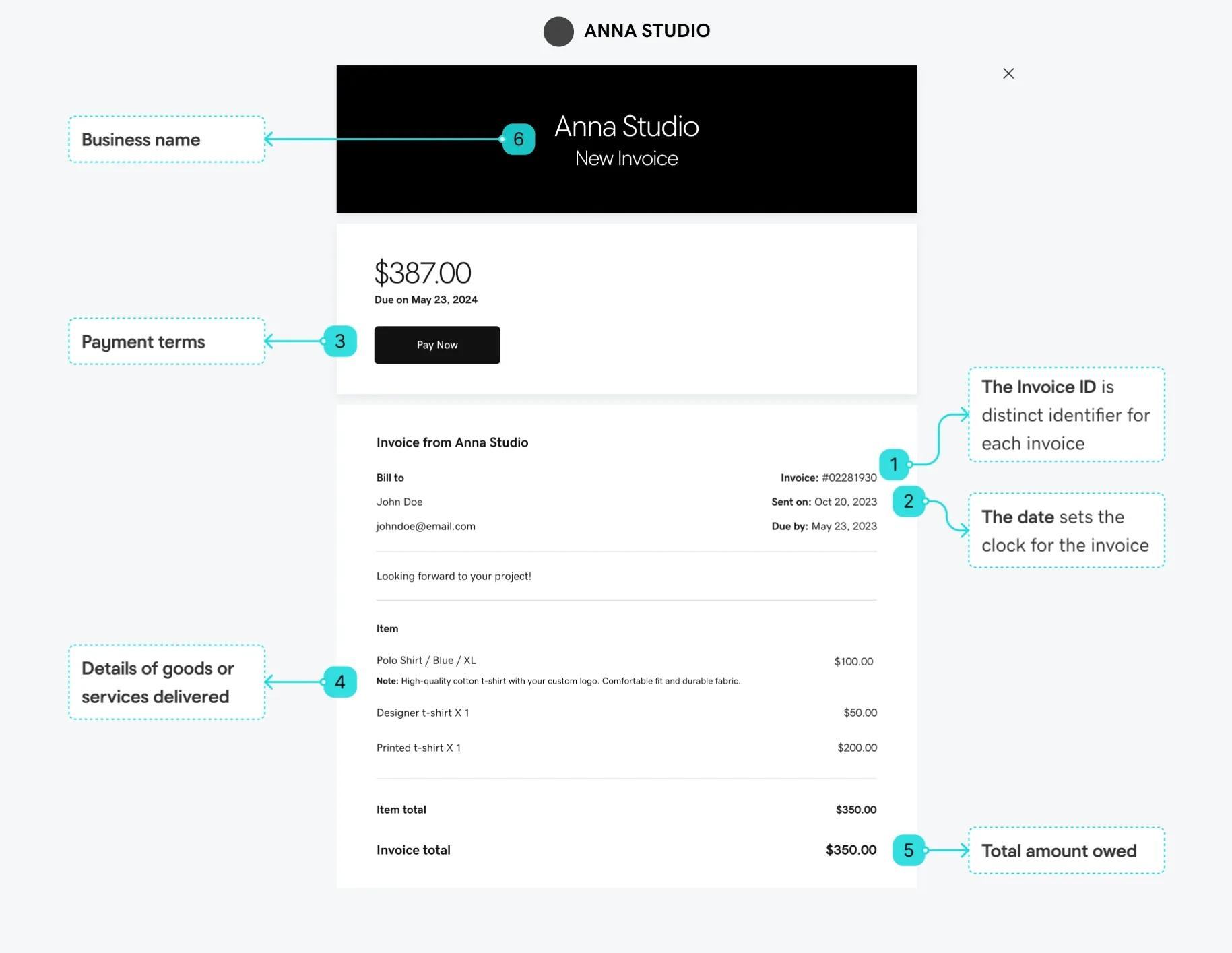

We’ve covered the basics of an invoice and its importance in the fast-paced world of business. Now, we’re going to look at the key components of an invoice.

1. Invoice number

When it comes to invoices in accounting, having an invoice number is essential. Your invoice number will give you a firm grip on how many invoices you’ve sent in a particular tax year while giving you a water-tight paper trail for your tax returns.

2. Invoice date

Like your invoice number, featuring the date of your invoice is vital for filing purposes. Including the date on your invoice will also make it quick and easy to find an invoice if you ever need to send a copy on or obtain specific pieces of information quickly.

3.Payment terms

Any good invoice will also include your payment terms. This will come in the form of how many days you expect to be paid from the date your invoice is sent—and it’s essential for keeping your business’s cash flow in good shape.

4. Details of the goods or services delivered

Your invoice should also feature a clear and concise list of the services or goods you’ve delivered to your client and customer. Doing so will give everyone a clear understanding of the particular invoice’s purpose and exactly what they owe.

When typing out your goods or services, you should include these details if applicable:

- The date you delivered the goods or completed the service

- How many units your client or customer has ordered

- The hours or time you worked on a particular project

- The rate per time or unit

- The total amount of money due

5. Total amount owed

Expanding on our last point, detailing the total amount of money owed is vital to getting paid the correct amount for your goods or services. You can include these additional details if they’re relevant:

- The subtotal

- Any applicable taxes

- Any extra fees

- Any possible promotional reductions or discounts

6. Business contact information

Including your business address, email, and phone number is also vital when preparing your invoice. Including your customers’ contact information (name, billing address, email, and telephone number) on the invoice is also important, as it keeps everything open, professional, and transparent.

That clears up the question, “what is an invoice cost?” The only thing left to say here is: make sure you also include your preferred payment method, whether that be a payment link, credit or debit card, digital wallets like Apple Pay or Google Pay, or bank transfer. If you don’t—you won’t get paid.

What are the main types of invoice?

While they share most of the same core details, there are different types of invoices to consider. Here, we look at the most common types you’ll come across in the business world.

Pro forma invoice

A pro forma is an invoice you send out in advance of delivering your goods or services. It’s typically used by businesses to give an outline of proposed costs before items are shipped or a project or job is finished.

Interim invoice

This type of invoice is used to request payment for services as you work through an agreed job or project. It’s a useful tool for keeping your cash flowing and managing your finances as you deliver specific milestones for a customer or client.

Recurring invoice

As the name suggests, this type of invoice is a recurring document sent out at regular intervals for ongoing goods or services. It’s an efficient way of maintaining good business relationships and receiving regular payment for a longstanding business arrangement.

Commercial invoice

This is a formal type of invoice that’s often used for businesses involved in international trade. This particular style of invoice is essential for smooth delivery and payment for overseas transactions as well as official customer clearance.

Timesheet invoice

A timesheet invoice is a document that many contractors or freelancers use to track as well as detail the amount of time they’ve worked on a particular job or project—and how much the client in question owes.

How to create an invoice: What you need to know

You can use a spreadsheet, word processor-style document or a dedicated piece of software to create your invoices—whatever method suits your business best.

To create a manual invoice that covers all essential bases, here are some tips you can follow:

| 1. Create your blank document | Set up an invoice template that features all of the key invoice components we’ve mentioned here in this guide. |

| 2. Gather your information | Collect all of the contact details you need to include in your invoice. Both yours and your client's or customer’s. |

| 3. List your goods or services | Itemize the goods or services you’ve provided, including quantity, description, time worked, and unit price. |

| 4. Calculate your totals | Work out the total cost, including taxes and discounts, if applicable. Add them to your invoice document. |

| 5. Add your payment terms | Outline the due date, payment methods, and any late fees. |

| 6. Review and download | Double-check for typos and make sure all of the details you’ve included in your are 100% accurate. Download into a preferred format (Word Doc, PDF., etc.) and send. |

| 7. File | File your invoice in a folder on your desktop or cloud software. Label it with the invoice number and data before adding it to a relevant folder. |

The importance of invoice management uncovered

So, why is slick invoice management so important? Well, as we said, filling and filing your invoices correctly is essential for creating a water-tight paper trail.

By keeping on top of your invoice management processes, you’ll be able to track your business income and performance with ease. Also, if you need a specific invoice or accounting or reference, having a solid filing system will save you an incredible amount of time and stress.

Managing your invoices professionally is also crucial for reconciliation purposes. With fluid invoice reconciliation, you can:

- Confirm and establish accuracy when it comes to requesting payment for your goods and services

- Quickly identify any mistakes or discrepancies if required

- Manage your cash flow with confidence and make accurate financial projections

The business-boosting benefits of digitizing your invoices

Having a paperless invoicing system comes with a wealth of business-boosting benefits. For starters, paper is perishable and easy to misplace.

Armed with a well-managed digital invoice system, you’ll make your business:

- More logistically and financially efficient

- More accurate and compliant

- More fluid and professional in the eyes of your clients and customers

- Greener and more environmentally friendly

- Better equipped to track track paid, unpaid, and overdue invoices, and fix errors if required

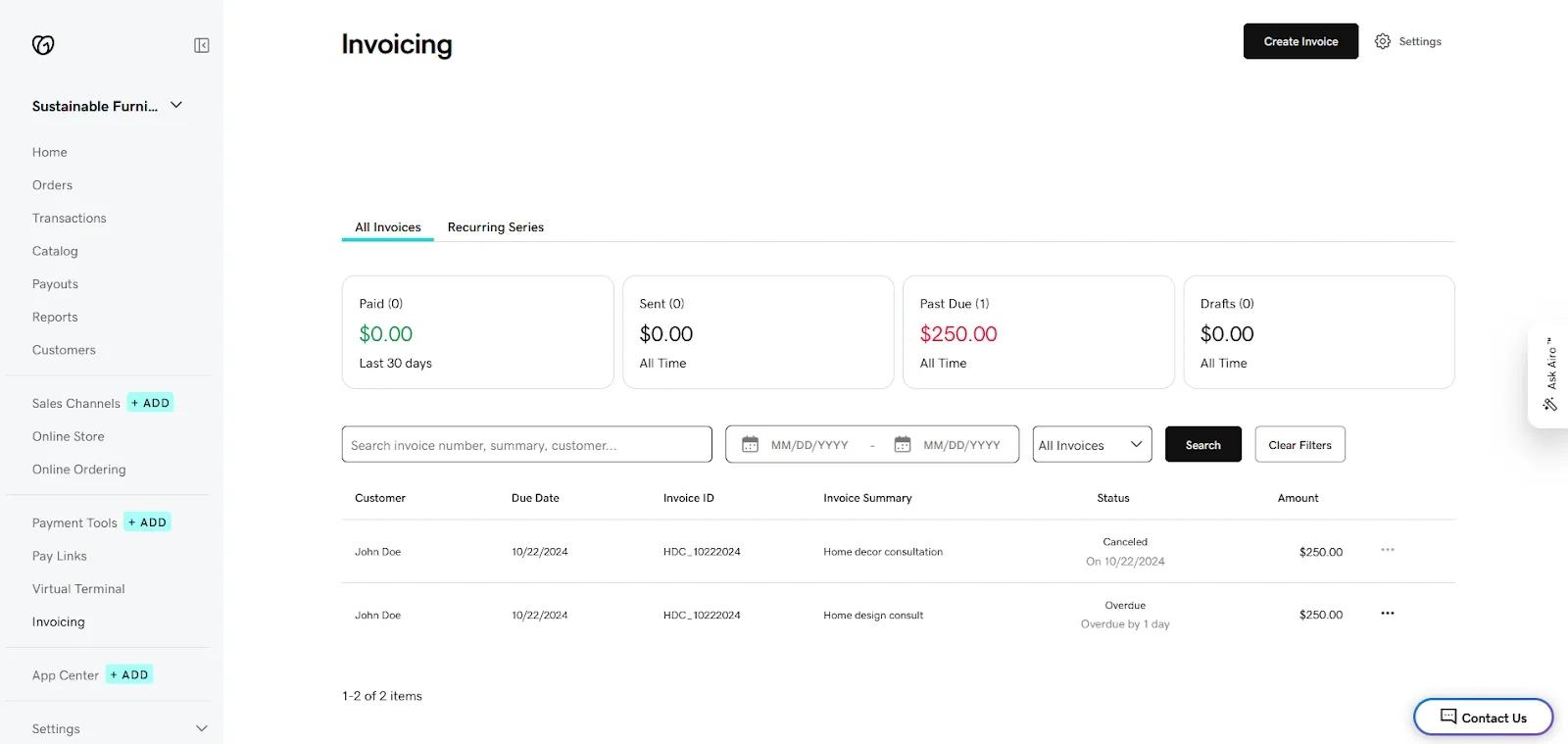

If you don’t want to raise invoices manually, the best option is to choose a dedicated piece of software.

When you’re choosing the right invoicing tool or software for your needs, you should consider your company’s budget, size, and business type.

Here are some other factors to consider when on the lookout for the ideal invoicing software for your business:

- Easy to use and edit invoice templates

- Automated features for tracking and filing invoice dates and numbers

- The ability to manage all of your invoices from one single dashboard

- Robust security features

- Excellent customer support

- Options for online payments – learn how to take payments online to streamline transactions

Final thoughts: The role of invoices in successful business

We’ve pondered the question, “What are invoices in accounting?”, considered the concept of invoice payment, and explored the benefits of digitizing your business affairs. The main discovery?

Invoices are an integral part of your business. These transactional documents act as a monetary bridge between your business and your customers, providing a means of tracking the delivery of your goods or services while keeping track of your core financial activities.

Without a slick invoicing process, your business can fall into chaos, stunting your cash flow situation while making your tax returns and financial projections messy.

Follow the advice in this guide, consider choosing a trusted tool for invoice management, and success will be yours for the taking.

FAQs

Is an invoice a bill or receipt?

Invoices are generally used to outline goods or services delivered and are sent to a customer or client to request payment. That said, they’re considered a bill rather than a receipt. For the latter we have a separate guide on how to write a receipt.

What is an invoice in simple words?

In simple terms, an invoice is a document issued by a seller to a buyer requesting payment for the goods or services they’ve provided. Business owners also file invoices to keep track of their financial records and make processes like filing tax returns more efficient.

Are invoices legally binding?

While invoices aren’t a legally binding agreement in an official sense, they do serve as an official record of goods or services delivered and payment requested. As an official and professional paper trail, you could use invoices as evidence should you need to pursue a client or customer who refuses to pay you without a legitimate reason.