Mileage tracker apps are a valuable tool for both small business owners and their teams. If your operations cause you or your employees to track travel that needs to be reimbursed, billed to clients — or if you want to deduct the expense of business travel on your tax return — the logistics can be a nightmare.

Manually recording time, travel, distance, the purpose of the trip, and receipts into a central location can be cumbersome for even the most organized person. Mileage tracking apps can do all the work for you, store valuable information and make reimbursements or deductions a painless process.

Related: What you need to know about writing off auto expenses

6 best mileage tracker apps for small businesses

While there are multiple mileage tracker apps, we’ve reviewed six of the best. Check out the costs, key features, pros and cons of each app.

- MileIQ.

- Hurdlr.

- QuickBooks Self Employed.

- SherpaShare.

- TripLog.

- Everlance.

A common feature of mileage tracker apps is automatic tracking, which is when an app uses the GPS on your smartphone to automatically track any car ride, and then logs that into your account. You’ll note we’ve explained if the apps include this feature and any specifications. App ratings are based on a five-point star system.

Let’s jump in.

Editor’s note: All features and prices listed are accurate at the time of publication.

1. MileIQ

- Cost

- Basic plan: free, limited to 40 trips per month

- Premium plan: $5.99/month or $59.99/year (paid annually)

- Teams plan: (enterprise) pricing available upon request

- MileIQ is included with Microsoft 365 from GoDaddy, in the Business Premium plan, with pricing starting at $9.99 user/month

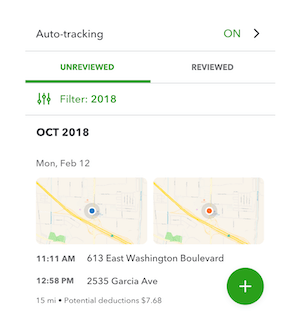

- Automatic mileage tracking: Yes

- Key features: Intuitive software learns your regular routes and locations — after minimal setup, the system runs itself

- Best for: Business owners looking for a mileage tracking system to set and forget with robust reporting capabilities, and companies with multiple employees that need to use the same system to track mileage

- App ratings

- Apple: 4.6 with 16,500 ratings

- Android: 4.5 with 49,523 ratings

MileIQ has intelligent software capabilities that recognize frequent trips and allow you to flag regular routes and locations. After you flag or confirm those routes, they’ll automatically be classified. You can also set work hours, including customized shifts. Anytime you drive during those times, miles will be tracked. Hours can be customizable, which is beneficial for owners or employees that work different hours each week.

The main benefit to MileIQ is ease of use — you can set up the app and have it run in the background of your phone.

There’s a simple swiping functionality when reviewing trips: swipe right for business, left for personal. The reporting system is fairly robust and can be accessed via your mobile device or the desktop dashboard.

While the free plan is limited to 40 trips per month, if your business is already using Microsoft 365 from GoDaddy, the premium version of the app is included at no cost.

Paid plans are on par with other options. The enterprise version is meant for teams with multiple employees that need to complete a mileage log approved by an administrator.

A potential drawback could be that the system only tracks miles. If you want a combined expense-tracking program or advanced accounting capabilities, options like Hurdlr might be a better option. Although you can integrate your MileIQ with QuickBooks or Freshbooks.

2. Hurdlr

- Cost

- Basic plan: Free, for single users

- Premium plan: $7.99/month or $59.88/year (paid annually)

- Automatic mileage tracking: Yes, available with a premium plan

- Key features: Integrations with other platforms and apps, the ability to track income and expenses to forecast profits and estimate taxes

- Best for: Freelancers, solopreneurs, real estate agents, or self-employed individuals that want an all-in-one expense tracker

- App ratings

- Apple: 4.7 with 4,100 ratings

- Android: 4.5 with 4,077 ratings

Hurdlr is a full-fledged expense tracker that you can use to track any business expense. This app is beneficial for anyone looking for more than just a mileage tracker. You can also integrate income into the accounting system to estimate taxes (based on expenses versus income).

What sets this app apart are the integrations with popular gig-economy platforms, like Upwork, as well as Airbnb and real estate-specific features.

The company markets themselves to self-employed contractors, freelancers, independent real estate agents and those who make supplemental income via renting homes. One downside is that automatic mileage tracking is not available on the free version.

3. QuickBooks Self Employed

- Cost: Self-Employed QuickBooks account: $10/month

- Automatic mileage Tracking: Yes

- Key features: QuickBooks can serve as your entire accounting software; you can add mileage from your tracker directly to invoices

- Best for: Self-employed individuals or small business owners looking for a mileage tracking app that automatically integrates into their accounting system

- App ratings

- Apple: 4.5 with 13,100 ratings

- Android: 4.4 with 19,108 ratings

QuickBooks offers a self-employed version (SEQB) with the lowest price tag, in comparison to their other business plans that also include mileage tracker apps. The automatic tracker works in the background of your smart device and records your travels via GPS. You can also manually add mileage as well.

The unique selling point with SEQB is the built-in functionality via the accounting platform.

Mileage from the app can automatically populate into your TurboTax account when you’re doing taxes (if you have it connected). You can also download IRS-compliant forms to give to your CPA or accountant.

If you charge clients for mileage, QuickBooks lets you add the mileage directly to a client’s invoice.

SEQB is only meant for one person. If you have employees, you’d be better to check out options like MileIQ enterprise or TripLog. Even for solopreneurs, a potential drawback is that SEQB cannot upgrade to another small business QuickBooks account. So if you plan to expand or add new employees, there might be extra work to switch over accounts.

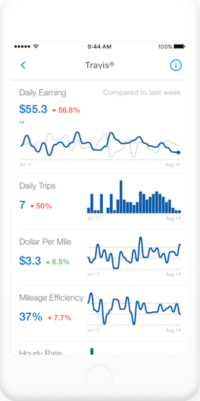

4. SherpaShare

- Cost

- Basic plan: $5.99/month or $59.88/year (paid annually)

- Super premium plan: $10 per month

- Automatic mileage tracking: Yes

- Key features: Unlimited mileage tracking, in addition to SmartDriver tools with helpful data and insights

- Best for: Rideshare drivers who want mileage tracking along with advice and tools on locations, routes, and ways to optimize earnings

- App ratings:

- Apple: 4.5 with 1,100 ratings

- Android: 4.5 with 2,891 ratings

Many business owners have side hustles to bring in extra income. If your side gigs include ridesharing for Uber or Lyft, SherpaShare stands out from other mileage tracker apps. It not only tracks all of your mileage for tax deductions but offers deep analytics to help you improve your driving profitability.

SherpaShare’s offers SmartDriver Tools that include:

- Hourly revenue and profit charts

- Heatmaps that plot other drivers’ locations so you can find underserved areas and revenue-maximizing intersections

- A driver-to-driver chat platform

- A compass that analyzes past fares and recommends profitable routes

You can use this mileage tracker app if you’re not a rideshare driver. But with the price tag and primary focus, it’s value is best used by Uber or Lyft drivers. For other business owners or solopreneurs, try out the other mileage tracker apps on the list.

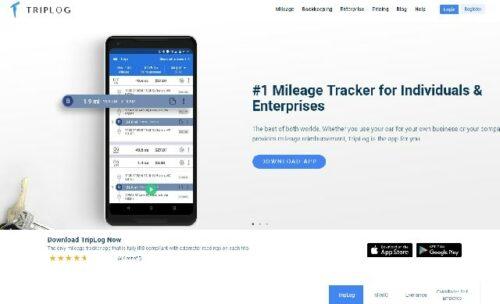

5. TripLog

- Cost

- Free plan: No automatic tracking, limited to five vehicles

- Basic plan: $2/month

- Premium plan: $4/month

- Enterprise version: pricing available upon request

- Automatic mileage tracking: Yes, with paid versions

- Key features: Lots of options—manual tracking, automatic tracking or plug-in to car’s bluetooth system; can also view routes directly on Google Maps

- Best for: Small businesses with multiple employees/contractors that need to track mileage on one system

- App ratings:

- Apple: 4.5 with 755 ratings

- Android: 4.6 with 2,387 ratings

With TripLog you can have multiple cars and drivers on one tracking system. A feature that sets TripLog apart from other mileage tracker apps is the various options for tracking miles: manual tracking, automatic tracking, connection to vehicle Bluetooth, iBeacon, OBD-II, Plug-N-Go and app widgets.

The enterprise version of TripLog is feature-rich. Not only does it support multiple drivers, but the administrator of the account can set-up variable rates, per diems, as well as track fuel purchases.

One con is that the free version only allows for manually adding trips, which slightly defeats the purpose of mileage tracker apps. However, the basic and premium plans are relatively inexpensive compared to the cost of other apps.

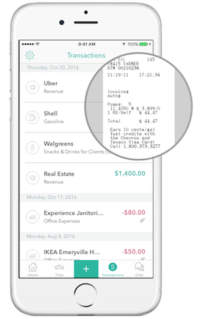

6. Everlance

- Cost:

- Basic plan: free, limited to 30 trips per month

- Premium plan: $8/month or $60/year (paid annually)

- Team plan: pricing available upon request

- Automatic mileage tracking: Yes

- Key features: Simplicity, the app creators (and reviewers) confirm the user interface is clean, simple and easy to use

- Best for: Self-employed contractors who want straightforward mileage tracker apps with expense tracking as an option

- App ratings:

- Apple: 4.9 out of 5,000 ratings

- Android: 4.7 with 9,993 ratings

Everlance is the highest rated mileage tracker app on the list. It’s a complete expense tracker, so you can keep tabs on mileage with the automated GPS system on your smart device, as well as record other expenses. The app’s accounting system generates IRS-compliant forms with itemized expenses for deductions at tax time.

Similar to MileIQ, with Everlance you can swipe to quickly categorize your trips as personal or business. While this app was rated the best mileage app for small business, it also boasts some big name corporate customers on their enterprise platform, like Century21 and Coca-Cola.

The free version is limited to 30 trips per month, so if you’re looking an unlimited, low-cost mileage tracker app, you might want to turn to another option.

Automate your reporting with mileage tracker apps

If you’ve ever attempted to guesstimate your mileage as a contractor or business owner, you know it isn’t an easy process. Reimbursing employees for mileage can also be difficult and drawn-out.

Mileage tracker apps make it easy to keep an up-to-date record of all business related driving, whether it be for you or your team members.

Apps allow you to set up the program and track mileage with limited time and management required. Use these business tools to minimize admin tasks, automate your reporting — and then use the extra time to focus on high-level tasks to grow your business.